954-465-6374

9 – 5 EST / M-F

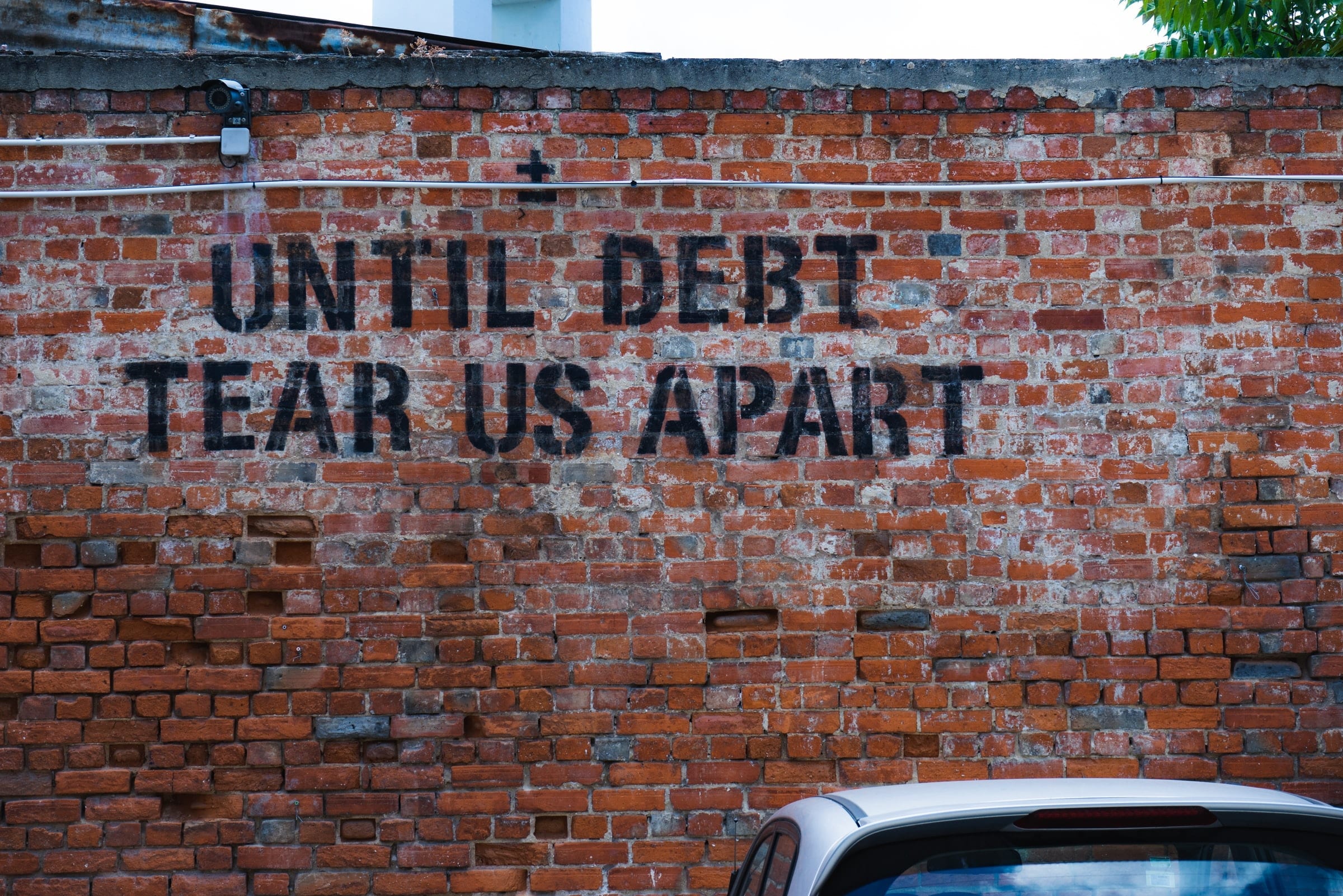

Money is often cited as a leading cause of trouble in a marriage, but it can also create issues in other relationships as well. It can lead to conflicts in marriages, among family members and even between friends. Why does this happen?

Well it happens for a variety of reasons. It can happen because people value and treat money differently. It can happen because of inequities in financial status among our family and friends. And it can happen when we value money more than relationships.

In our most intimate relationships where there should be partnership and a sense of working together, we struggle with our own financial baggage, our family history with money and relationships and how we value money versus how those issues relate to those of our partner or spouse. You may have two people who come from very different backgrounds where one was raised to believe gifts equal love and that has resulted in the desire to spend to feel and give love and the other grew up with a constant lack of security and they see money as safety and want to save every dollar they can. The conflict between the spender and the saver can create ongoing battles and unhappiness.

In families where there are inequities and one person or family has significantly more wealth than other family members, there can be feelings of resentment and anger from those who don’t have the same level of wealth and even guilt by those who do. There can be a sense of entitlement from other family members that the wealthy family member owes the rest of the family. The wealthy family member can feel like the local bank when other family members are hitting them up for a loan or a gift whenever they are running short on funds. This creates an inequity in the family relationship and can lead to a lifetime of conflict and discord.

Even in our friendships, we can have problems that are created or exacerbated by financial differences. When you have friends who are or have become wealthy and you are not, those differences can put a wedge in that relationship. An example can be as simple as going out to dinner. If you are with a group and everyone but you has a sizable bank account and the bottles of wine are flowing and with each glass and call for another round, you are getting the sinking feeling in your stomach because you realize this bill is going to equal your next paycheck, you will likely not attend the next dinner. If you are the wealthy friend, do you feel obligated to pick up the tab for the rest of your friends or are you expected to because you have a bigger bank account? Do you begin to spend your time with friends who share a similar level of wealth to avoid the potential awkwardness of those situations?

So how to we resolve these conflicts? We do so with boundaries with our family and friends, compromise and communication with our partners and appreciating our relationships and all they bring to our lives.

Our relationship with our spouses and partners is one of the most significant relationships in our lives. You need to find what works for you and it won’t be the same for everyone. Do you have a spending account you are free to use how you see fit? Do you have a savings or investment target that must be reached first and then you divvy what is left after bills. Do you need to be all in together to make it work? You need to find the common ground and go from there. If you can’t find that place on your own, I recommend reaching out to a neutral third party to help. Engage a therapist (there are even financial therapists) or a daily money manager or a wealth manager or someone else who specializes in the areas where you are struggling.

(As a side note: I will say that NO spouse should be entirely dependent on the other to function financially. Each person should have their own credit card and their own retirement accounts and their names on the bank account in case the relationship doesn’t work or a spouse passes away. I have seen too many situations where one spouse is starting from scratch because their spouse was listed on everything and they haven’t established any credit history or assets of their own.)

You cannot be a revolving bank account for all of your family and friends. You don’t have to look far to find stories of celebrities or athletes or lottery winners who became wealthy overnight and everyone they knew hit them up for money and they quickly lost it all. Just do a Google search for athletes and bankruptcy to see what I mean. They didn’t know how to say no or protect their own interests and they often didn’t understand the potential shelf life of their careers. They spent freely, they gave to friends and family and they ended up broke.

You need boundaries. One of my rules for my clients is not to lend money to friends and family if they have an expectation that they will get it back. If the relationship will be fractured if the money isn’t returned, don’t lend it, give it. And if you can’t afford to give it or you don’t want to give it away, don’t do it at all. Decide your comfort level and stick to it. And if you can’t say no, hire someone who can say no for you. That might be your daily money manager, your wealth manager, your agent or your manager, but find someone who can create that barrier for you.

And lastly, prioritize those relationships that are important to you. You cannot control what others will do and say and how they will react to your financial status (newly acquired or not), but you can control how you react to them. Decide what you are willing to do and what you are not willing to do and stick to it or find professionals who can help guide and advise you and then help you stick to it. If the people in your life don’t respect those boundaries, those are relationships that you might need to evaluate and decide if they were important to begin with. If they are worth holding onto, utilize your financial and relationship professionals to help you navigate a better way to keep that relationship with boundaries you are comfortable with.